Manage foreign exchange risks

Lock in an exchange rate, up to 24 months and stop unpredictable economic variables from effecting your bottom line.

Lock in your currency exchange rate

With AD Capital Markets deliverable forward contracts, you benefit from a guaranteed exchange rate to pay invoices denominated in foreign currencies.

Predetermined reserves of foreign currencies, your deliverable forward contracts can be used at a future date or within a given period, up to two years after signing them.

What is a Forward Contract?

When is it used?

A Forward Contract is an arrangement that allows you to transfer money at some time (up to 24 months) in the future at an exchange rate that you agree to now, so that you know what the exchange rate will be at the time the transaction takes place. This allows you to avoid the risks and uncertainties associated with adverse exchange rate movements.

Forward Contract: Benefits

A Forward Contract may be beneficial for businesses and individuals if exchange rates are particularly attractive now, and you want to lock in that rate to hedge against uncertainty in the future. This can be especially helpful for small businesses who want to keep their cash flows predictable when buying or selling overseas.

Forward Contract: Elements to Consider

Entering into a Forward Contract is a binding arrangement. Therefore, a Forward Contract may preclude you from taking advantage of exchange rate movements of your currency pair if the exchange rate moves in your favour. To continue to take advantage of exchange rate movements, some customers use a Forward Contract for only part of their liability as a way to partially hedge against volatility.

We aim to supply 0% deposits but you may be asked to pay a deposit at the time of booking a Forward Contract, or during the life of the Forward Contract (a “margin call”). No interest is paid on deposits.

What is a Dynamic Forward?

Dynamic forwards with full participation

Like all dynamic forward contracts, dynamic forwards with full participation secure a business’s sales margins by fixing a predefined exchange rate, or “protection rate”. This enables this company to make a future foreign-currency payment without fear of adverse fluctuations. “Full participation” means the contracting party may only take advantage of the pre-agreed rate, or an improved market rate, once the contract has reached maturity. There is, however, a set-up charge.

In sum, a business can:

protect its margins with a guaranteed exchange rate.

benefit from a favourable FX market fluctuation at the settlement date.

Example:

A small European business named Sirocco places an order for goods amounting to $120,000 (USD), which it will pay in 12 months. At the time of order, the exchange rate (often referred to as the spot rate or reference rate) is EUR 1 = USD 1.2000.

With the help of a forward contract, Sirocco can guarantee today’s exchange rate and countervalue for the future invoice. By choosing a dynamic forward with full participation, they will also have the option of buying dollars at a more favourable rate at the payment date, depending on market conditions.

At the payment date, there are two possible scenarios:

Scenario 1

The EUR/USD reference rate is less favourable than the guaranteed protection rate, at EUR 1 = USD 1.1000. Sirocco therefore opts for the guaranteed protection rate of EUR 1 = USD 1.2000, buying $120,000 for a countervalue of €100,000 to settle its invoice.

Scenario 2

The EUR/USDreference rate is more favourablethan the guaranteed protection rate, at EUR 1 = USD 1.3000. Sirocco thus opts for the reference rate of EUR 1 = USD 1.3000, buying $120,000 for a countervalue of €92,308 to settle its invoice.

Dynamic forwards with partial participation

Like dynamic forwards with full participation, this option allows businesses to benefit from a more favourable market rate at the payment date. However, this only applies to a predetermined percentage of their forward payment. Dynamic forwards with partial participation also aim to secure a business’s sales margins by fixing a guaranteed protection rate that guards against negative FX market developments. Contrary to dynamic forwards with full participation, however, they require no set-up fee.

In sum, a business can:

protect its margins with a guaranteed exchange rate, slightly below the initial spot rate, for a proportion of their future payment.

benefit from a favourable FX market fluctuation at the settlement date for the remaining percentage of their future payment.

avoid the set-up costs of a dynamic forward with full participation.

Example:

A European mid-cap named Khamsin places an order for goods costing $120,000 (USD), which it will pay in 12 months. At the time of order, the exchange rate is EUR 1 = USD 1.2000.

By setting up a dynamic forward with partial participation, Khamsin can secure a minimum future exchange rate, or protection rate, of EUR 1 = USD 1.1800 for a proportion of the future payment. The business also maintains the option of buying the remaining percentage of its future dollars at a better rate, depending on currency market conditions at maturity.

At the payment date, there are two possible scenarios:

Scenario 1

The EUR/USD reference rate is less favourable than the guaranteed protection rate, at EUR 1 = USD 1.1000. Khamsin opts for the guaranteed protection rate of EUR 1 = USD 1.1800, buying $120,000 for a countervalue of €101,695 to settle its

Scenario 2

The EUR/USD reference rate is more favourable than the guaranteed protection rate, at EUR 1 = USD 1.3000. Khamsin can therefore benefit from this improved rate, but only for a predetermined percentage of the nominal value at set-up. In this case, 50%.

In line with the agreed terms, Khamsin does the following:

It buys 50% of its dollars (USD) at the more favourable exchange rate of EUR 1 = USD 1.3000. $60,000 are therefore bought for a countervalue of €46,154.

It buys the remaining 50% at the guaranteed protection rate of EUR 1 = USD 1.1800. An additional $60,000 is therefore bought for a countervalue of €50,847.

Overall, to settle its invoice of $120,000, Khamsin has paid €97,001. The average buying rate for the entire conversion amounts to EUR 1 = USD 1.2400

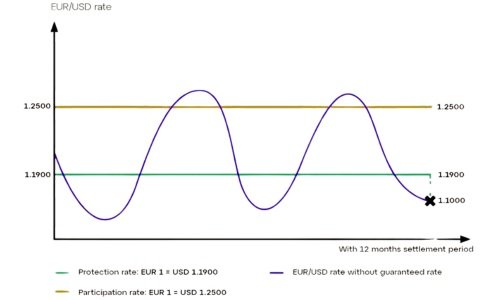

Dynamic forwards with capped participation

As with all dynamic forwards, the aim here is to benefit from a more favourable exchange rate once the contract has reached maturity. When it comes to dynamic forwards with capped participation, a business can once again safeguard its sales margins through a guaranteed protection rate. However, its ability to benefit from advantageous FX market fluctuations is limited to a capped exchange rate at the payment date. This is known as the participation rate.

In sum, a business can:

protect its margins with a guaranteed exchange rate, slightly below the initial spot rate.

benefit from a favourable FX market fluctuation at the settlement date, but only up to a predetermined exchange rate referred to as the participation rate.

avoid the set-up costs of a dynamic forward with full participation.

Example:

An EU-based SME called Bora places an order for goods costing $120,000 (USD), which it will pay in 12 months. At the time of order, the exchange rate is EUR 1 = USD 1.2000.

By setting up a dynamic forward with capped participation, Bora can guarantee a protection rate of EUR 1 = USD 1.1900 for its invoice. Opting for this kind of dynamic forward means the business can benefit from a favourable FX market development up to a specified exchange rate known as the participation rate, but not beyond this. The outcome will depend on FX market conditions at maturity.

At the payment date, there are three possible scenarios:

Scenario 1

The EUR/USDreference rate is less favourablethan the guaranteed protection rate, at EUR 1 = USD 1.1000. Bora therefore avails of the guaranteed protection rate of EUR 1 = USD 1.1900, buying $120,000 for €100,840 to settle its invoice.

Scenario 2

The EUR/USD reference rate finds itself between the protection rate and the participation rate, at EUR 1 = USD 1.2200. Bora therefore avails of the reference rate, buying $120,000 for €98,361 to settle its invoice.

Scenario 3

The EUR/USDreference rate is higher than the participation rate, at EUR 1 = USD 1.3000. Bora therefore cannot avail of the reference rate, benefitting instead from the favourable FX market fluctuation only up to the participation rate, at EUR 1 = USD 1.2500. Bora buys $120,000 for €96,000 to settle its invoice.

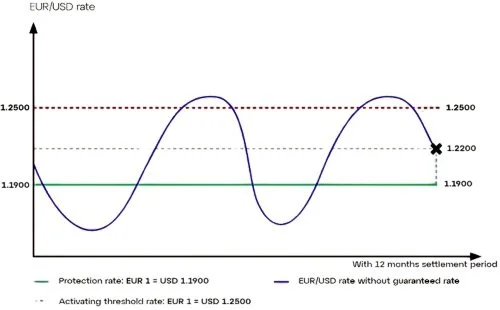

Dynamic forwards with activating participation

Dynamic forwards with activating participation are similar to those with capped participation, but there is slightly more at stake. Once again, by setting up this kind of contract, a business protects its sales margins with a guaranteed protection rate. Its ability to benefit from favourable FX market fluctuations is, however, limited to a capped exchange rate at the payment date, known as the activating threshold rate. There is a key distinction here. If the reference rate at maturity exceeds the activating threshold, the business is obliged to avail only of the guaranteed protection rate.

In sum, a business can:

protect its margins with a guaranteed exchange rate, slightly below the initial spot rate.

benefit from a favourable FX market fluctuation at the settlement date, but only up to a predetermined exchange rate referred to as the activating threshold.

avoid the set-up costs of a dynamic forward with full participation.

Example:

A medium-sized European business called Mistral places an order for goods costing $120,000 (USD), which it will pay in 12 months. At the time of order, the exchange rate is EUR 1 = USD 1.2000.

Through a dynamic forward contract with activating participation, Mistral is able to guarantee a protection rate of EUR 1 = USD 1.1925 to pay its invoice. Choosing this kind of dynamic forward means the business can benefit from a favourable FX market development up to a specified exchange rate known as the activating threshold. However, if the reference rate has exceeded this by the time the contract reaches maturity, Mistral will find itself obliged to accept the guaranteed protection rate.

At the payment date, there are three possible scenarios:

Scenario 1

The EUR/USD reference rate is less favourable than the guaranteed protection rate, at EUR 1 = USD 1.1000. Mistral therefore avails of the guaranteed protection rate of EUR 1 = USD 1.1925, buying $120,000 for €100,629 to settle its invoice.

Scenario 2

The EUR/USDreference rate finds itself between the protection rate and the activating threshold, at EUR 1 = USD 1.2200. Mistral therefore avails of the reference rate, buying $120,000 for €98,361 to settle its invoice.

Scenario 3

The EUR/USD reference rate is higher than the activating threshold, at EUR 1 = USD 1.3000. Mistral therefore cannot avail of the reference rate, availing instead of the guaranteed protection rate, at EUR 1 = USD 1.1925. Mistral buys $120,000 for €100,629 to settle its invoice.

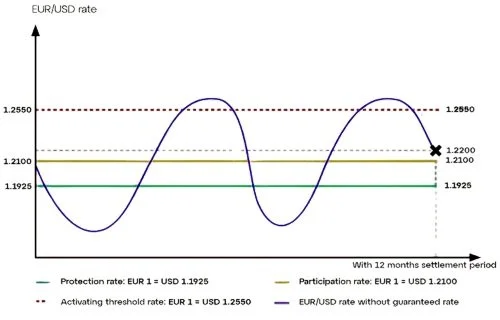

Dynamic forwards with capped activating participation

Dynamic forwards with capped activating participation differ slightly from the previous two contracts. As with other dynamic forwards, a business can use them to protect its sales margins with a guaranteed protection rate. Its ability to benefit from favourable FX market fluctuations is limited to a capped exchange rate at the payment date, known as the activating threshold. A participation rate is also set, above the guaranteed protection rate and below the activating threshold. While the business can benefit from a reference rate at maturity that climbs up to the activating threshold, it will be obliged to avail of the participation rate if this threshold is surpassed.

In sum, a business can:

protect its margins with a guaranteed exchange rate, slightly below the initial spot rate.

benefit from a favourable FX market fluctuation at the settlement date, but only up to a predetermined exchange rate referred to as the activating threshold. If this threshold is exceeded, it avails instead of a predefined participation rate.

avoid the set-up costs of a dynamic forward with full participation.

Example:

A European mid-cap named Pampero places an order for goods costing $120,000 (USD), which it will pay in 12 months. At the time of order, the exchange rate is EUR 1 = USD 1.2000.

Using a dynamic forward contract with capped activating participation, Pampero can benefit from a guaranteed protection rate of EUR 1 = USD 1.1925 for its invoice. Opting for this dynamic forward variant enables the business to benefit from a favourable FX market development up to a specified exchange rate known as the activating threshold. However, if the reference rate has exceeded this by the time the contract reaches maturity, Pampero will find itself obliged to accept the participation rate instead. This nonetheless sits above the protection, with both rates are determined at set-up.

At the payment date, there are three possible scenarios:

Scenario 1

The EUR/USD reference rate is less favourable than the guaranteed protection rate, at EUR 1 = USD 1.1000. Pampero therefore avails of the guaranteed protection rate of EUR 1 = USD = 1.1925, buying $120,000 for €100,629 to settle its invoice.

Scenario 2

The EUR/USD reference rate finds itself between the protection rate and the activating threshold, at EUR 1 = USD 1.2200. Pampero therefore avails of the reference rate, buying $120,000 for €98,361 to settle its invoice.

Scenario 3

The EUR/USDreference rate is higher than the activating threshold, at EUR 1 = USD 1.3000. Pampero therefore cannot avail of the higher rate, instead benefitting only from the participation rate, at EUR 1 = USD 1.2100. Pampero buys $120,000 for €99,174 to settle its invoice.

FX forward contracts are designed to neutralise foreign exchange risk, which is a major challenge for businesses making regular foreign-currency payments. Currency market volatility can bear a negative impact on sales margins, making forwards a compelling option for businesses in this position. Dynamic forwards eliminate risk and enable businesses to benefit from potentially advantageous currency fluctuations, but they come in many forms.

Dynamic forwards with full participation guarantee a future exchange rate either above or equal to the spot rate, but they involve a set-up charge. Those with partial participation require no such fee, but the benefits of favourable FX movements are limited to a mere proportion of the future payment. Dynamic forwards with capped, activating or capped activating participation all set a limit on both the amount the contracting party can gain or lose out on as a result of forex market volatility, with varying levels of risk.

The forward contract your business chooses will depend on the volume of your multicurrency payments and the volatility observed in the currency pairs you’re accustomed to. But all SMEs and mid-caps making cross-border payments should consider a proactive currency hedging strategy. Ignoring currency risk is a major oversight for any business serious about protecting its margins. The strength of dynamic forwards lies in going beyond mere risk protection, offering the opportunity to harness FX market volatility and benefit from it too.

FAQ’s

-

The main benefit of forward contracts is that they allow you to fix the exchange rate that you’ll use when making your next international business payment.

This gives you the ability to plan ahead with a degree of certainty, knowing exactly how much money will leave your account when you purchase items denominated in foreign currencies.

If the prevailing rate favours your business, it makes sense to lock the rate, as this will mean that you’ll be protected from unfavourable shifts in the exchange rate.

Regardless of what happens in the foreign exchange markets, you can rest assured that you’ll receive the forward exchange rate that was secured by your forward contract.

-

If you run a business, it is highly likely that you will regularly have to meet the cost of large invoices or make orders of goods sold abroad.

With a currency forward contract, you can mitigate the risk that the currency markets can pose to such purchases, thereby ensuring that the prices that you pay for these items do not rise because of unfavourable moves in the foreign exchange markets.

Given the protection that they can afford, forward contracts are often used by businesses as hedging strategies to reduce their currency exposure.

-

A forward contract, is just one of the many foreign exchange tools that we offer at AD Capital Markets.

Depending on your facility agreement, We offer 0% deposit but we may require you to provide a deposit in order to secure your forward dependant of company balance sheet.

This is something that you are welcome to discuss with our dedicated Relationship Manager, who will inform you as to whether, in addition to the cost of your forward contract, you will need to provide a deposit. They will also be more than happy to talk you through the other foreign exchange instruments that we have to offer.

-

Our forward contracts typically allow you to secure an exchange rate for up to two years. With a AD Capital Markets business account, you’ll be able to agree the terms of your forward contract with your Relationship Manager. This will determine the duration of your forward contract and the amount that is to be paid, as well as address any queries or concerns that you may have.

We provide a wide range of other FX solutions that can help meet your business’s needs, in addition to our foreign exchange forward contracts..

-

The main advantage of forwards contracts is that they eliminate the downside risk exposure through a fixed future rate. They provide a degree of certainty, allowing businesses to protect their budgets from fluctuations in currency prices and lock in favourable rates ahead of time.